Trio Candlestick Patterns

Last Update: 21 December,2016After basic, single and double, now we will go through the Triple Candlestick Patterns i.e. candlestick patterns, which are formed by a combination of three candlesticks, these trio candlestick patterns are an important tool to analyze the price action for any currency pair in the forex market because it gives us an edge by providing the price action information very quickly within three candlesticks rather than lagging.

Trio candlestick patterns are basically one of the best technically analyzing tools because they accurately and immediately after completing the formation of a third candlestick reflects the forex market’s indecision and/or a reversal of the current trend, the most important trio candlestick patterns are as following

The Two Beautiful Stars Twinkling in The Forex Market

A Morning star and an evening star are the two beautiful stars twinkling in the forex universe; these two stars are related as in the chronological order like a sunrise and a sunsetMorning Star

Morning star is a sunrise candlestick pattern i.e. the price starts advancing like a rising sun giving a sign of a fresh new morning i.e. the price starts appreciating after reaching the bottom in a bearish trend.

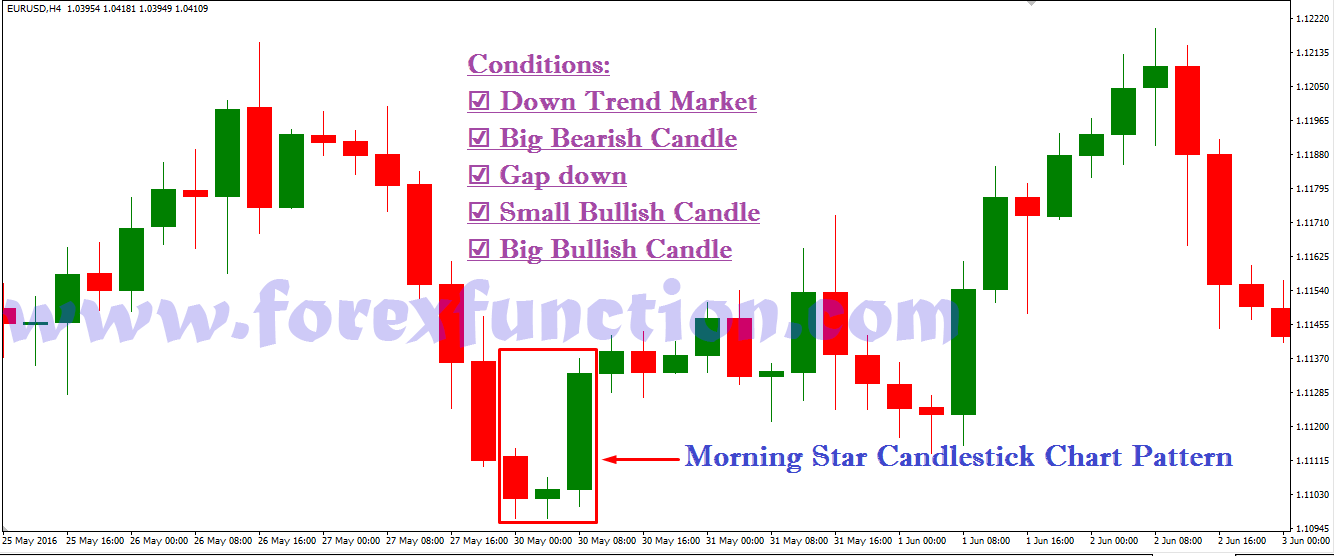

The illustration above shows the formation of a morning star. A morning star candlestick pattern is formed by the combination of 3 candlesticks in a bearish trend if a small candlestick like a spinning top or a doji is formed after a strong bearish candlestick and then followed by a strong bullish candlestick, as a result, we get a tiny twinkling morning star reflecting the market information that the night is coming to an end and get ready for a fresh new morning because a small candlestick reflects the indecision in the market and the bullish candlestick reflect the increase in the buying pressure.

Basic Criteria for Identifying a Morning Star Candlestick Pattern

☑️ The first candlestick is a strong bearish candlestick at the bottom of a bearish trend.☑️ The second candlestick has a small real body and is like a spinning top or doji reflecting the indecision in the market.

☑️ The third candlestick is a strong bullish candlestick closing at the minimum 50% of the first bearish candlestick acting as a confirmation of the increase in buying pressure.

Evening Star

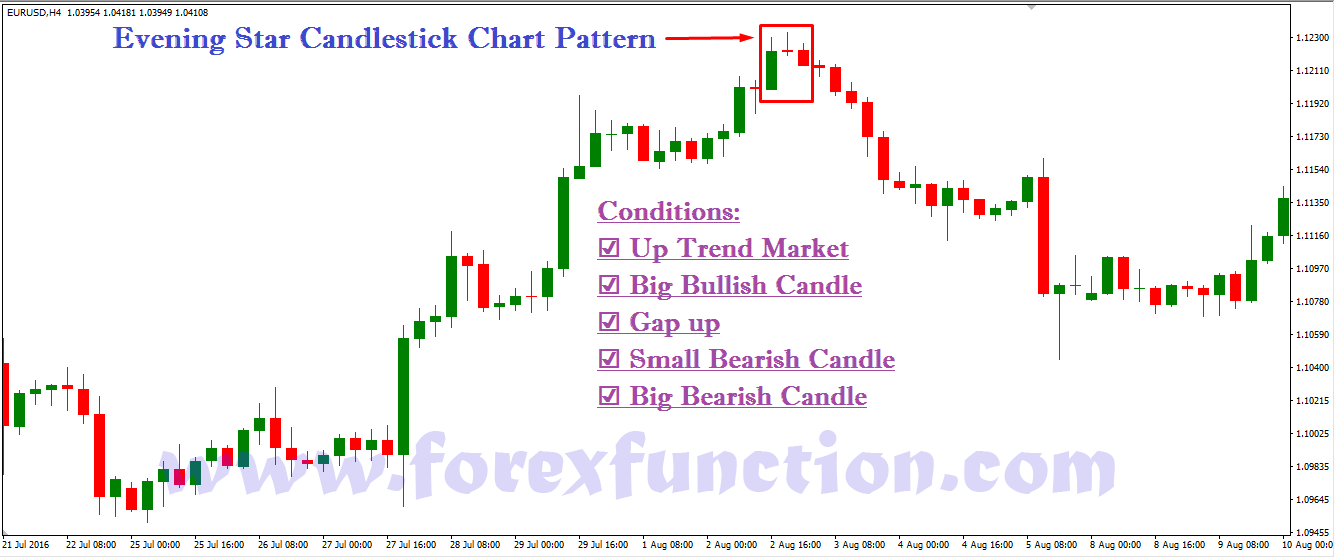

Evening star is a sunset candlestick pattern i.e. the price starts declining like a sunset giving a sign that the day is now coming to an end, as a result, the price starts declining after reaching the top in a bullish trend.

The illustration above shows the formation of an evening star. An evening star candlestick pattern is formed by the combination of 3 candlesticks in a bullish trend if a small candlestick like a spinning top or a doji is formed after a strong bullish candlestick and then followed by a strong bearish candlestick, as a result, we get a tiny twinkling evening star reflecting the market information that the day is coming to an end and get ready to enjoy the beautiful evening because a small candlestick reflects the indecision in the market and the bearish candlestick reflect the increase in the selling pressure.

Basic Criteria for Identifying an Evening Star Candlestick Pattern

☑️ The first candlestick is a strong bullish candlestick at the top of a bullish trend.☑️ The second candlestick has a small real body and is like a spinning top or doji reflecting the indecision in the market.

☑️ The third candlestick is a strong bearish candlestick closing at the minimum 50% of the first bullish candlestick acting as a confirmation of the increase in selling pressure.

Three Inside Up & Down Candlestick Patterns

These candlestick patterns are much more powerful than the twinkling stars because as the stars are only reflecting the beginning of a day and night, these three inside up and down candlestick patterns are reflecting much more than them i.e. the day or night has already begun and now you should get ready to work or party hard.Three Inside Up

Three Inside Up is a bullish reversal pattern formed at the bottom of a bearish trend. A three inside up candlestick pattern consists of 3 candlesticks having a good real size bodies.Basic Criteria for Identifying a Three Inside Up Candlestick Pattern

☑️ The first candlestick is a strong bearish candlestick at the bottom of a bearish trend.☑️ The second candlestick is a bullish candlestick whose real body size is at least 50% of the first bearish candlestick.

☑️ The third candlestick is a strong bullish candlestick closing above the high of the first bearish candlestick reflecting the market information that now the bulls are powerful and are ready to push the prices.

Three Inside Down

Three Inside Down is a bearish reversal pattern formed at the top of a bullish trend. A three inside down candlestick pattern consists of 3 candlesticks having a good real size bodies.Basic Criteria for Identifying a Three Inside Down Candlestick Pattern

☑️ The first candlestick is a strong bullish candlestick at the top of a bullish trend.☑️ The second candlestick is a bearish candlestick whose real body size is at least 50% of the first bearish candlestick.

☑️ The third candlestick is a strong bearish candlestick closing below the low of the first bullish candlestick reflecting the market information that now the bears are powerful and are ready to pull the prices.

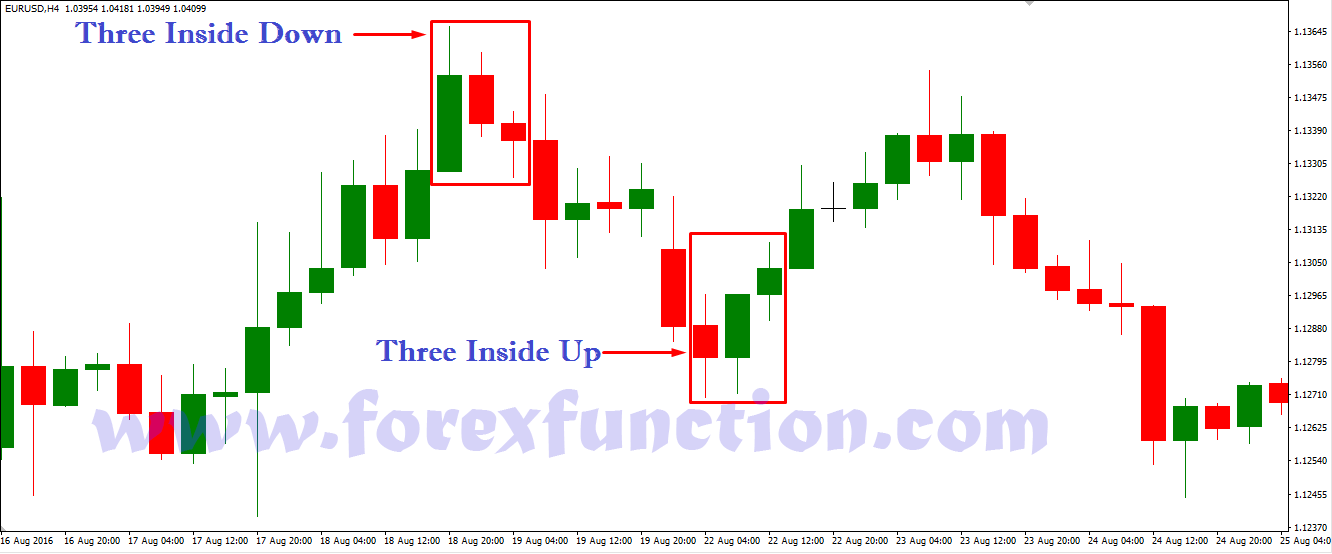

Example of Three Inside Up & Three Inside Down Candlestick Pattern

The illustration above shows the formation of a three inside up candlestick pattern. In a bearish trend, if a bullish candlestick of good size is formed after a strong bearish candlestick and then followed by another strong bullish candlestick, as a result, we get a three inside up candlestick pattern reflecting the market information that the bears have tried their best in pulling the prices lower, but due to some reason bulls have reacted very strongly and built two consecutive bullish candlesticks of good sizes breaking the high of the last strong bearish candlestick and due to the increase of momentum in buying pressure, a potential reversal and/or market indecision might result the prices to move in an opposite or sideways direction.

The illustration above shows the formation of a three inside down candlestick pattern. In a bullish trend, if a bearish candlestick of good size is formed after a strong bullish candlestick and then followed by another strong bearish candlestick, as a result, we get a three inside down candlestick pattern reflecting the market information that the bulls have tried their best in pushing the prices higher, but due to some reason bears have reacted very strongly and built two consecutive bearish candlesticks of good sizes breaking the low of the last strong bullish candlestick and due to the increase of momentum in selling pressure, a potential reversal and/or market indecision might result the prices to move in an opposite or sideways direction.

Kindly remember in the above illustrations, all candlestick patterns were eligible for trading because they were confirmed by an opposite direction trending candlestick before entering the trade, as a result, the trade was successful because price respected the twinkling stars and three inside up/down candlestick patterns by moving in the appropriate direction.

Cautionary Words

Now this does not mean that every time you see a trio candlestick pattern, you should trade it, because doing such a thing would be gambling, but in order to profit from a candlestick pattern, it is recommended to wait for the price confirmation in order to take calculated low risks for higher profits i.e. let the bulls and bears show their power by pushing or pulling the prices, as a result, by showing a price confirmation candlestick after every candlestick pattern and also remember, the price should not make a fresh high or low than the high or low of every respective candlestick pattern before opening a position if it does, then the candlestick pattern is not powerful enough for leading the prices.Conclusion

Kindly remember, all candlestick patterns are very useful and should be used as a tool for confirmation of a trade setup with your personal trading strategy. A single candlestick and all candlestick patterns provide the best possible probabilities for speculating the future price movement and also we are able to achieve miraculous rewards while trading forex if they are properly used in context i.e. if any single candlestick and/or all candlestick patterns is formed at a support and resistance levels; we get a double price confirmation and hence we are able to profit from a low risk trading opportunity to reap huge profits.Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !