How to Identify & Implement Support and Resistance Levels?

Last Update: 17 December,2016Support and Resistance are the best classic technical trading tool; an absolute majority of forex traders use these price levels to speculate the future moves of the market. Support and Resistance price levels can also be interpreted in a simple way as price levels of Demand and Supply. It is one of the best trading concepts used in the forex trading market. As support and Resistance levels are used by almost everyone in the forex trading market, everyone seems to have their own unique idea of measuring as what are the support and resistance price levels.

What exactly are the Support and Resistance Price Levels in a Chart?

Concept of Support And Resistance

What is a Support Price Level?

Strong Support Price LevelSupport level is a historical price level on the forex chart, where the demand is so strong that the price could not decline from that particular price level. We can easily understand from this explanation that a support price level is the best buy price level because, at these price levels, many traders are willing to buy i.e. there is more demand than supply and as soon as the price reaches support zone, it appreciates very quickly and continues on appreciating until the supply diminishes.

Where is The Support Price Level Established? The very first and important point to be noted is that there is no definite or exact support price. Support is established in a small price range known as a support level and/or support zone.

Illustration of Strong Demand and Support Zone

In the above EURUSD, H4 chart, you will find a support level at 1.1120 prices. Why, we are saying this as a support zone, it’s because every time the price declined and reached this level, due to high demand, it appreciated and even after testing 3 times, the demand is still strong at this price level. This level will be called as a support level until the price closes below this price level.

What is a Resistance Price Level?

Strong Resistance Price LevelResistance level is a historical price level on the forex chart, where the demand is so strong that the price could not advance further from that particular price level. We can easily understand from this explanation that a resistance level is a bestselling price level because, at these price levels, many traders are want to go short i.e. there is more supply than demand and as soon as the price reaches the resistance zone, it starts declining very quickly and continues on declining until the supply diminishes.

Where is The Resistance Price Level Established?

The very first and important point to be noted is that there is no definite or exact resistance price. Resistance is established in a small price range known as resistance level and/or resistance zone.

Illustration of Strong Supply and Resistance Zone

In the above EURUSD, 4 hours chart, you will find a resistance level at 1.1034 prices. Why, we are saying this as a resistance zone, it’s because every time the price appreciated and reached this level, due to high supply it declined and even after testing 3 times, the supply is still strong at this price level. This level will be called as a resistance level until the price closes above this price level.

Price Levels testing Our Patience

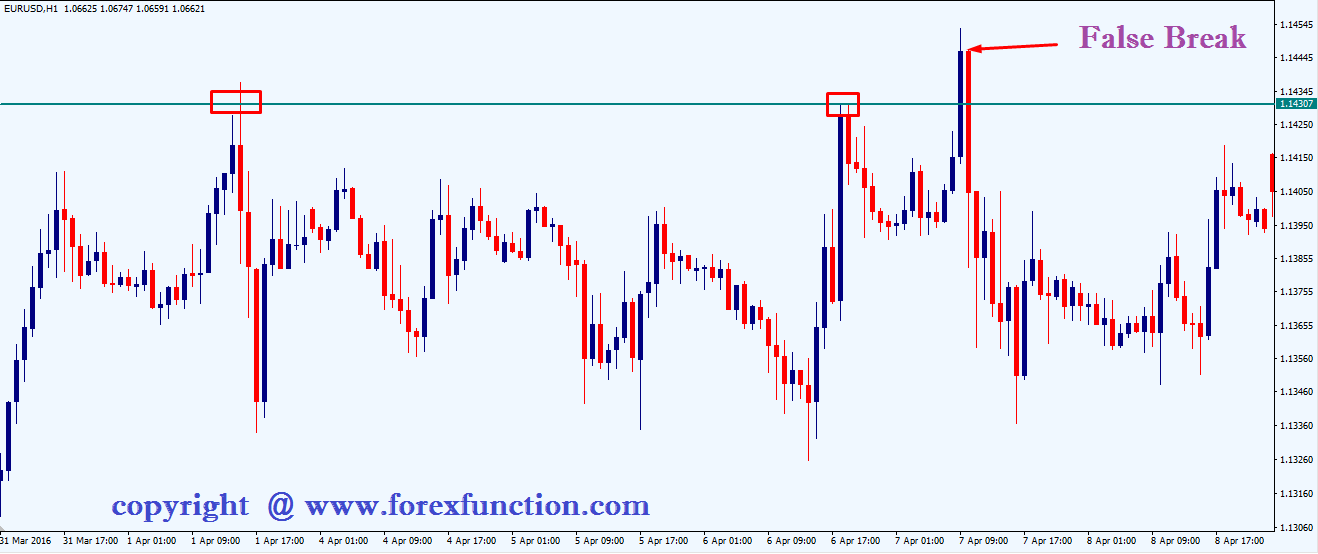

Support and Resistance price levels can be very easily understood as Demand and Supply levels, but still many traders interpret and use them differently. Defining a support and resistance level can be tricky sometimes, let’s see in the following picture whether a price level is broken or not?Illustration of False Breakout on a Support Level

In the above EURUSD, 1 hour chart, you will find that after the price had tested twice a perfect resistance level was established, after that the price did break that level and also closed above, logically the resistance level has broken, but after a couple of hours, we observe that this was a false breakout, and yes, this is a resistance level, which has now become stronger due to the rapid price appreciation.

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !