AUD/USD bears resume after engulfing pattern : FxWirePro | November 7, 2017

AUD/USD bears resume after engulfing pattern, shooting star propels major downtrend – Tunnel spreads to leverage trade yields and short hedge:

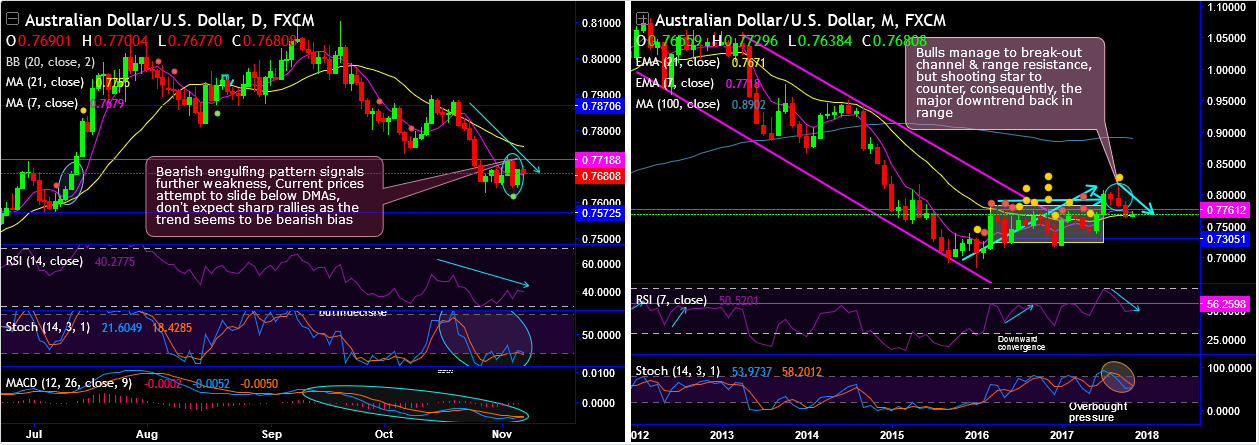

From last two weeks, AUDUSD -0.11% trend has been drifting through non-directional mode. Bearish engulfing patterns has occurred at 0.7646 levels to signal weakness.

The stiff resistance is observed at 0.7718 levels, the momentary spikes in the recent past have attempted to break-out above this stiff resistance, but the failure swings have resulted into price drops again.

For now, we foresee more slumps as both leading as well as indicators signal weakness in this pair. 7DMA crosses below 21DMA which is a bearish crossover, while MACD shows bearish crossover sliding below zero level which is a bearish trajectory. RSI and stochastic curves evidence downward convergence to indicate selling interests.

On a broader perspective, it was also stated in our previous post that the major trend breaching long lasting range and sloping channel in the consolidation phase (refer monthly chart), and it was stated that “we get a little scepticism on further rallies as we trace out shooting star formation in last month’s candle (refer monthly charts), the major trend is bearish biased”. Consequently, bears have managed to show their effects by evidencing price dips upon the formation of this bearish pattern (refer monthly chart).

The stiff resistance level was observed at 0.8075 – 0.8125 range that was rejected, while the strong support is seen at 0.7875 – 0.78 levels which has now been broken downside.

Both leading oscillators ( RSI & stochastic ) on this timeframe, indicate overbought pressures, while lagging oscillators (both MAs & MACD ) have been little indecisive.

Hence, contemplating above technical rationale, at spot reference: 0.7682, upon breach below 0.7679 (i.e. 7DMA) the intraday speculators can easily eye on minimum southward targets upto 30-40 pips, thus, snap rallies and deploy tunnel spreads using upper strikes at 0.7710 and lower strikes at 0.7639.

Currency Strength Index: FxWirePro's hourly AUD spot index has shown -3 (which is neutral), while hourly USD spot index was at -57 ( bearish ) while articulating at 06:25 GMT .

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !