Technicals And FxWirePro Derivatives Trading Setup for USD/JPY | June 18, 2019

USDJPY has slid below 7&21-SMAs and shown slumps about -0.22% for the day.

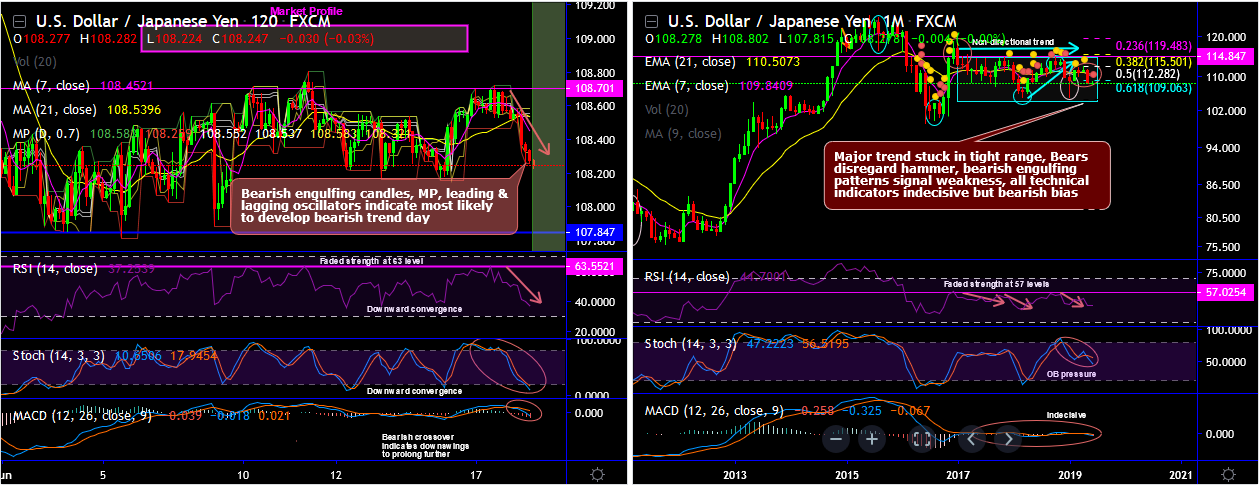

Market profile on 4H:

Point of control ( PoC ) is at 108.445,

Unfair highs – 108.583

Unfair lows – 108.259

Value area ( VA ) – 108.583– 108.321

21-SMA – 108.5393

7-DMA – 108.4523

Stiff resistance – 21-SMA and 108.701 levels. The previous upswings are restrained below these stiff resistance levels.

RSI – Faded at 63 levels, and shows downward convergence to the prevailing slumps to indicate selling strength in the ongoing downtrend.

At this juncture, we could foresee bearish trend sentiments to prolong as the minor trend of the pair has failed at around the stiff resistance of 108.701 levels quite a few times in the recent past upon the bearish MACD crossover.

Well, on the other hand, if the market is imbalanced, it seeks to find the point of control which is the fair price, and that’s where it will have an equal number of options holders and writers. It is most likely to generate a big trend day as the prevailing price revolves around the new PoC .

On a broader perspective, the major downtrend has now resumed with a bearish candle of big real body (refer monthly plotting) after the formations of bearish engulfing candles, slumps below EMAs have retraced more than 61.8% Fibonacci levels as both leading on this timeframe are also in tandem with the selling sentiments and lagging indicators are quite indecisive but bearish EMA & MACD crossover signals weakness.

Trade tips: At spot reference: 108.285 levels, contemplating above technical rationale, it is wise to snap any deceptive rallies to initiate fresh short build ups for targets up to 108.158 levels with strict stop loss of 108.389 level, thereby, one can attain 1:2.5 risk/reward which can keep us at a smart edge.

Alternatively, on hedging grounds ahead of Fed and BoJ’s monetary policies that are scheduled for this week, shorting USDJPY futures contracts of mid-month tenors have been advocated, we now like to uphold the same positions as the underlying spot FX likely to target southwards below 106 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly JPY spot index is inching towards 144 levels (which is highly bullish ), and hourly USD spot index has bearish index is creeping at 101 (highly bullish ) while articulating (at 05:39 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !