Time for AUD/USD long liquidation as momentary upswing exhausts | May 29, 2019

Time for AUD/USD long liquidation as momentary upswing exhausts at stiff resistance, uphold short hedges on double top extension:

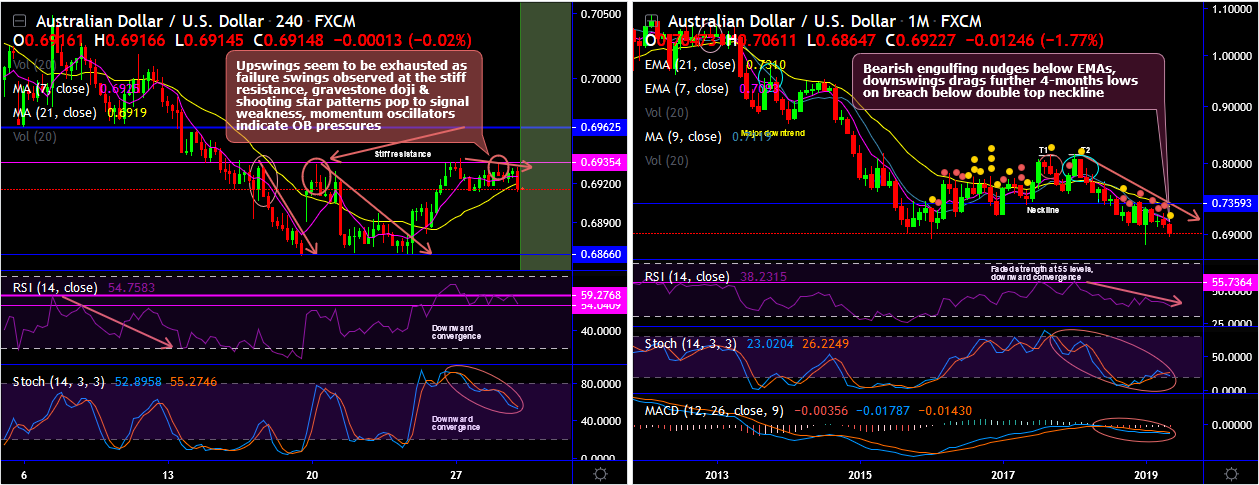

Technical chart and candlestick patterns: In the minor trend, the prevailing upswings of AUDUSD seem momentary as the failure swings were observed at 0.6935 level which has been acted as the stiff resistance.

The pair has formed shooting star and gravestone patterns at this juncture. The recent upswings were also exhausted at the same areas, with the sharp bearish engulfing and gravestone doji candles at 0.6909 and 0.6920 levels respectively (refer daily plotting). Consequently, the steep slumps can be seen as a result

For now, the shooting star has occurred at 0.6925 levels that is coupled with the overbought pressures signaled by both the leading oscillators.

On the contrary, the extension of rallies is possible only upon break-out above stiff resistance, otherwise, steep slumps are most likely upon slide below DMAs.

In addition to that, this bearish pattern is coupled with a broader perspective: The major trend of this pair has been extending double top formation with breach below neckline and may head towards 1 and a half year lows (refer monthly plotting), bearish engulfing candle followed by shooting star patterns plummet prices well below 7EMA again on this timeframe. Attempts of upswings are restrained below 21-EMA levels.

Both RSI and stochastic curves have signaled faded strength and indecisiveness.

While bearish MACD and EMA crossovers substantiate the bearish sentiments and indicate downtrend to prolong further.

Trade tips: On trading perspective, at spot reference: 0.6926 levels, squeeze the longs contemplating above technical rationale, it is advisable to execute tunnel spread options strategy using upper striking options at 0.6945 and lower short lower strikes at 0.69 levels, thereby, one can achieve certain yields as long as the underlying spot FX keeps dipping but remains well above lower strikes on the expiration.

Alternatively, on hedging grounds ahead of RBA’s monetary policy that is scheduled for the next week, we advocated shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.68 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 74 levels (which is bullish ), while hourly USD spot index was at 0 (absolutely neutral) while articulating (at 06:24 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !