USD/JPY Chartpack - Technicals & Trade Setup | May 14, 2019

USD/JPY bearish trade setup as bears breach below double top neckline:

A Glance at Technical Analysis:

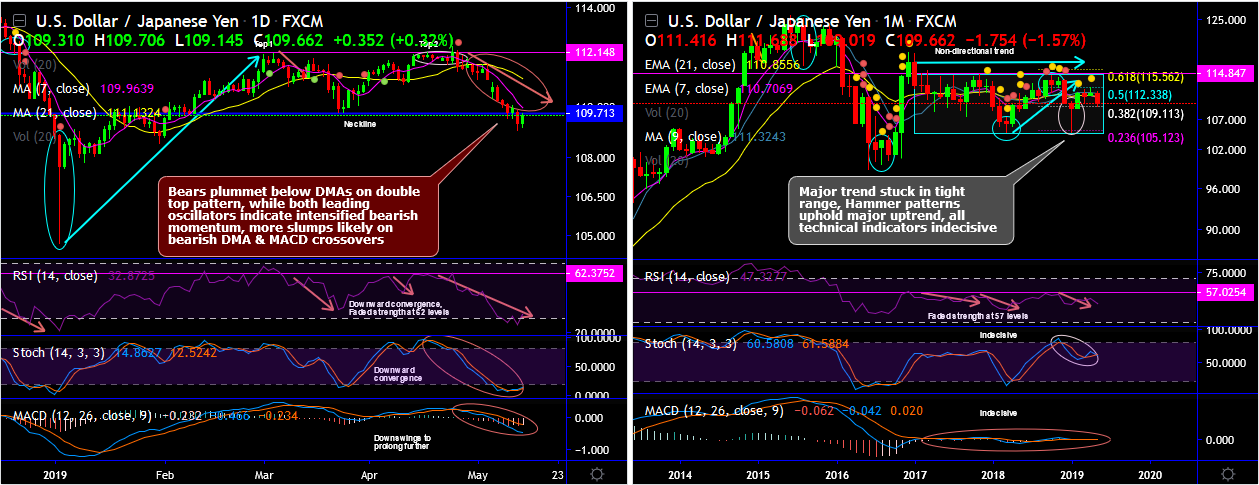

USDJPY minor trend has been nudging below DMAs after failure swings at stiff resistance of 112.148 levels and double top pattern, top 1 is at 112.137 and top 2 is seen at 112.400 and neckline is at observed at 109.713 levels.

Bears managed to breach below the double top neckline at 109.713 level, while both leading oscillators indicate intensified bearish momentum, more slumps likely on bearish DMA & MACD crossovers (refer daily plotting).

On the flip side, the major trend has been in the consolidation phase, even if the rallies extend, maximum targets are up to 61.8% Fibonacci levels in the medium run, however, we couldn’t foresee much chance for this event. While trend indicators are indecisive, we see bullish invalidation on retrace below. Hammer patterns have occurred at frequent intervals, ever since then the price rallies have been considerable, but bearish patterns, such as, hanging man and shooting stars have occurred at peaks that restrain the bullish prospects.

Well, bulls in the overall major trend, seem to be exhausted at 61.8% Fibonacci levels from the lows of June 2016, (refer monthly plotting), the trend on this timeframe, is stuck in a tight range.

Trade Tips: Contemplating above technical rationale, at spot reference: 109.700 levels, it is wise to bid tunnel spreads with the upper strikes at 109.9694 and at 109.145. The strategy is likely to fetch leveraged yields as long as the underlying spot FX keeps dipping but remains well above lower strikes on the expiration.

Alternatively, on hedging grounds, we advocate shorting USDJPY futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 107.318 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly USD spot index was at 136 (which is highly bullish ), while hourly JPY spot index was at -26 (mildly bearish ) at 04:54 GMT .

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !