EUR/USD’s both minor and major trends develop descending channel | April 4, 2019

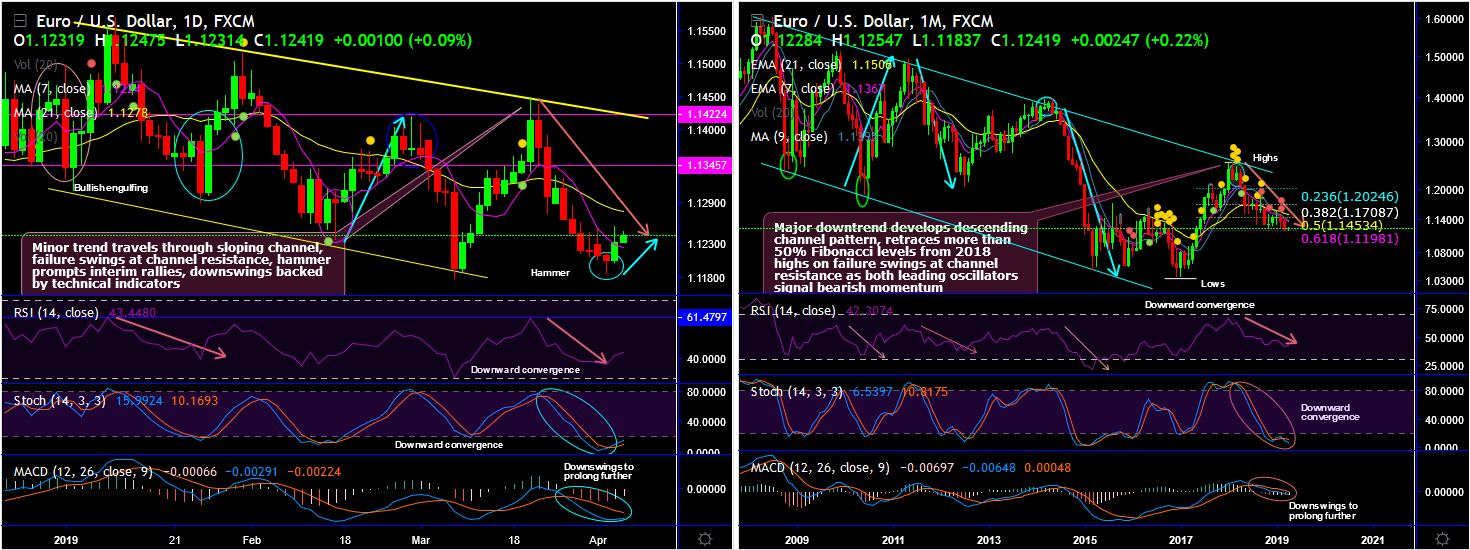

EURUSD has formed the sloping channel in both minor and major trends (refer daily and monthly charts).

The bullish streaks are observed 2-3 days in a row upon the formation of the hammer pattern candle at 1.1204 levels. However, the interim upswings are not backed by the momentum indicators nor by trend indicators; the current prices are spiking above 7-DMAs that may drag mild rallies but certainly, it should not be deemed as a reversal of the major trend which highly bearish (refer daily chart ).

In fact, we had raised a caution for aggressive bulls in our previous post a fortnight ago. For more reading, please refer below weblink:

https://www.econotimes.com/FxWirePro-EUR...

While the major downtrend has also been sliding through the sloping channel, where bears retrace 61.8% Fibonacci levels from 2018 highs on the failure swings at channel resistance as both leading oscillators signal bearish momentum (refer monthly chart).

Shooting star pattern pops-up at peaks in the major trend, ever since then you could make out bears have shown their effects, steep slumps have gone below EMA levels and retraced more than 61.8% Fibonacci levels of January 2018 highs (i.e. 1.2612) and January 2017 lows (i.e. 1.0371 levels) (refer monthly chart).

Overall, the current minor trend seems to be little bullish but still remains well below 21-EMAs despite today’s rallies in a short-run, bears are most likely to extend major downtrend and hit 2-year lows again.

We could foresee more slumps on cards as both leading oscillators ( RSI and stochastic curves) and both trend indicators (EMAs & MACD ) have been signaling intensified bearish momentum and downtrend continuation respectively.

Trade tips: At spot reference: 1.1241 levels, contemplating above technical rationale, one can execute boundary strikes options strategy. Such exotic option with upper strikes at 1.1265 and lower strikes at 1.1224 (i.e. 7DMA levels) likely to fetch exponential yields than spot moves. By choosing this strategy, one can participate in the prevailing rallies but not disregard the major trend.

Alternatively, shorting futures of mid-month tenors have been advocated with a view of arresting further potential slumps, we wish to uphold the same. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 57 levels (which is bullish ), while hourly USD spot index was at 28 (mildly bullish ) while articulating (at 05:36 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !