EUR/USD upside traction only on breach above channel resistance | March 18, 2019

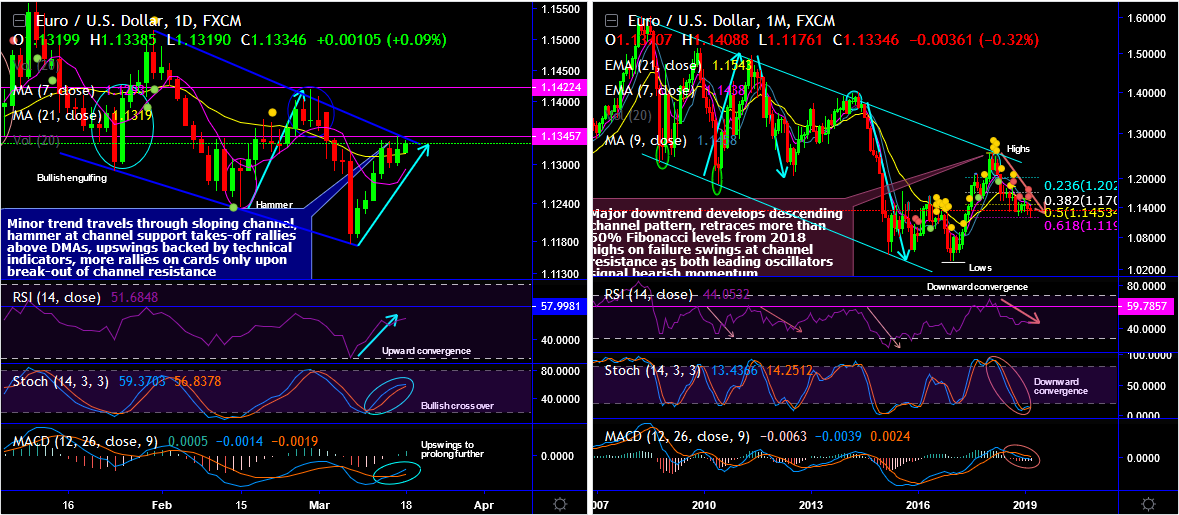

EURUSD minor trend travels through the sloping channel, hammer occurs at channel support (refer daily chart ). Consequently, The price rallies are back in form from 2ndweek of March, having cushioned at channel support rallies took-off above DMAs.

The upswings are backed by technical indicators, for now, more rallies seem to be on the cards only upon break-out of channel resistance.

Both RSI and Stochastics oscillators show upward convergence to indicate intensified buying momentum.

We now look out for a decisive break-out of crucial resistance at around 1.1345 areas which would likely develop further bullish sentiment with next resistance of 1.1385 and 1.1422 levels.

Otherwise, one can see 1.1319 and 1.1293 as the next strong supports are also potential southward targets - that ahead of the 1.1175 recent lows.

On the medium-term perspective, we view 1.12 - 1.08 as a major support region and the ideal area for a long-term higher low over the 1.0340 lows set in 2016. Notable supports within this region lie at 1.1190 and 1.1000. We need further evidence that 1.1215 was the higher low we are looking for.

The major downtrend develops descending channel pattern, retraces more than 50% Fibonacci levels from 2018 highs on failure swings at channel resistance as both leading oscillators signal bearish momentum (refer monthly chart).

Trade tips: On trading perspective, at spot reference: 1.1335 levels, contemplating above technical rationale, it is advisable to deploy double touch call option strategy using upper strikes at 1.1345, the strategy is likely to fetch leveraged yields as long as the underlying spot FX keeps rising on the expiration.

Alternatively, on hedging grounds ahead of Fed’s monetary policy that is scheduled for this week, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 1.1175 levels in the medium term.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly EUR is flashing at 70 ( bullish ), hourly USD spot index is sliding towards -96 levels (which is bearish ), while articulating (at 05:30 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !