AUD/USD Short Setup As Bears In Line With Technical Indicators | February 19, 2019

The RBA minutes will provide some further information on the Board’s view but most of the detail has already been revealed in Governor Lowe’s speech and the Statement on Monetary Policy .

On RBA minutes, Aussie has attempted to rally up to 0.7116 levels, the pair should now remain in the upper part of the past week’s range around 0.7150 levels.

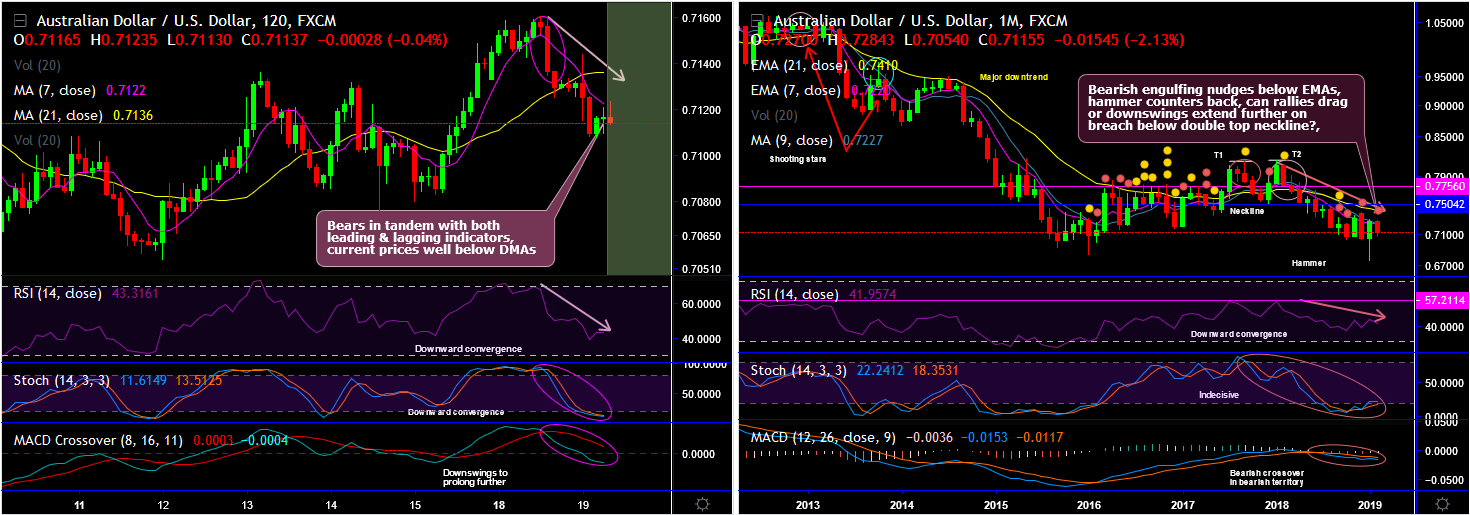

In AUDUSD minor trend, a resembling bearish engulfing pattern has occurred at 0.7136 levels, consequently, the bears have plummeted prices below DMAs (refer 2H plotting).

Bears are now in tandem with both leading and lagging indicators, the current prices well below DMAs.

Both RSI and stochastic curves are showing downward convergence to the price dips that indicate strength and momentum in the current downtrend.

To substantiate this bearish stance, bearish DMA and MACD crossovers indicate downtrend to prolong further.

AUDUSD on a broader perspective: Last month, the hammer pattern has occurred at 0.7270 levels. The major trend has been extending double top formation with a breach below the neckline and likely to head towards 1 and a half year lows (refer monthly plotting), bearish engulfing candle followed by shooting star patterns plummet prices well below 7EMA again on this timeframe.

Both RSI and stochastic curves have constantly been showing downward convergence on this timeframe as well to signal bearish momentum. While we see bearish EMA and MACD crossovers with rising volumes with dipping prices, this indicates downtrend to prolong further.

Trade tips: On trading perspective, at spot reference: 0.7113 levels, capitalizing abrupt upswings, it is advisable to execute tunnel spread strategy with upper striking options at 0.7125 and lower short lower strikes at 0.7085 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping but remains well above lower strikes on the expiration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.69 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -52 levels (which is bearish ), while hourly USD spot index was at -53 ( bearish ), while articulating (at 06:27 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !