GBP/JPY Chartpack - Technicals & Trade Setup | February 7, 2019

Last month’s GBPJPYupswings now seem to have been absolutely halted (the January month’s rallies show up to 2.10%), the current trend is going back again under the control of bears’ business upon the streaks of bearish patterns. This week, the pair has shown slumps about 0.69% so far.

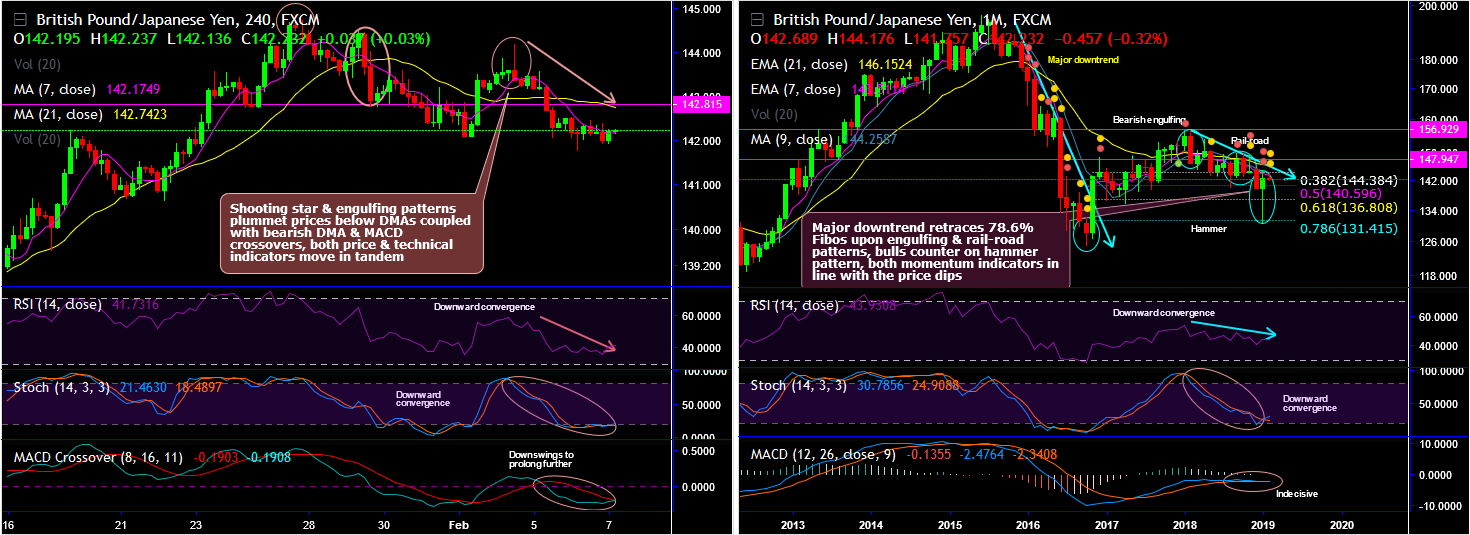

Technical analysis (chart and candlestick patterns occurred): On daily plotting, ever since the formation of the back-to-back shooting star and hanging man candles have occurred at peaks of rallies.

The shooting star at 143.539 and 143.362, hanging man at 143.591 levels on the 4H chart, the bears have managed to hamper the previous bullish swings. Selling sentiments have continued further price dips below 7SMAs.

To substantiate this bearish outlook, SMA and MACD crossovers coupled with the above-stated candlesticks signal further weakness. While both RSI and stochastic curves show downward convergence to the prevailing price dips that indicate the intensified bearish momentum.

On a broader perspective, the major downtrend that went in the consolidation phase has now continued bearish streaks again (refer monthly plotting), where the bearish engulfing pattern has occurred at 146.754 and rail-road pattern at 144.165 levels on monthly terms to nudge prices below EMAs.

The major downtrend retraces 78.6% Fibonacci levels upon engulfing & rail-road patterns, hammer most likely to occur at 142.721 levels. Bulls counter on the most likely hammer , both momentum indicators in line with the price dips. As a result, today’s trend has been attempting to slide further below 7SMAs.

Trade tips: At spot reference: 142.159 levels, one can still uphold shorts in futures contracts of mid-month tenors with a view to arresting further potential downside risks. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Alternatively, on daily trading grounds, we advocate constructing tunnel spread, using upper strikes at 142.332 and lower strikes at 141.908 levels. The strategy is likely to fetch leveraged yields as long as the underlying price keeps dipping but remains above lower strikes on the expiration.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 5 (which is neutral), while hourly JPY spot index was at 35 ( bullish ) while articulating (at 06:24 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !