NZD/USD Technicals, Trading and Hedging Tips:FxWirePro | September 26, 2018

NZD/USD trading and hedging tips as momentary bulls bounce back on hammers and bears in major trend breach triple top neckline:

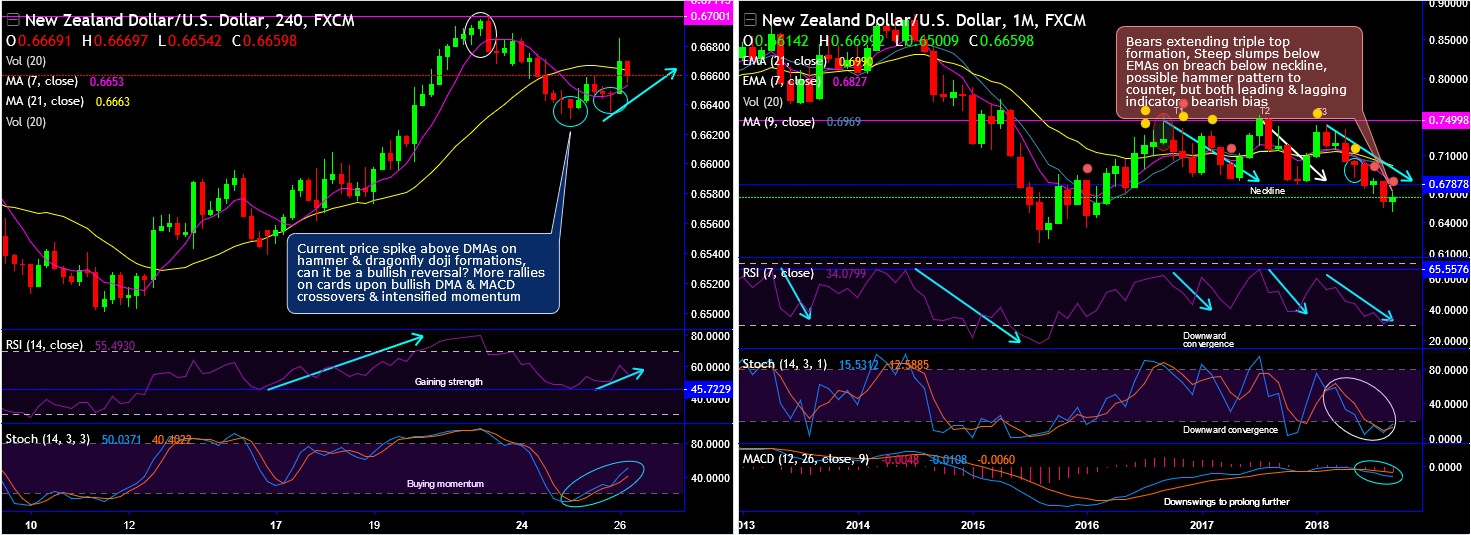

Although streaks of NZDUSDrallies that have now gone above DMAs upon hammer and dragonfly doji formations at 0.6638 and 0.6647 levels, minor trend of this pair have sensed the stiff resistance at 0.67 levels.

So, can it be a bullish reversal? Well, that is too early to declare. For now, more rallies seem to be on cards upon intensified momentum (refer daily plotting).

On the major trend, the pair forms triple top pattern with top1 at 0.7485, top2 at 0.7558, top3 at 0.7437 and neckline at 0.6787 levels.

Consequently, bears are extending price slumps. Please observe steep slumps below EMAs and breach below neckline (refer monthly chart). Although a resembling hammer pattern is popping up in this month’s candle that attempts to counter the slumps, but both leading and lagging indicators have still been bearish bias.

Bearish EMA and MACD crossovers, on this timeframe, indicate the downswings are most likely to extend further. To substantiate this bearish stance, both leading oscillators show constant downward convergence to the prevailing price slumps that signal intensified bearish momentum ahead of today’s RBNZ monetary policy scheduled on September 26th.

Any failure swing at stiff resistance (0.67 levels), downtrend seems most likely on bearish crossovers signaled by the lagging indicators. Hence, amid the mild bullish sentiment, it is not wise to conclude this as bullish trend reversal on daily terms. Instead, optimally utilize deceptive rallies to deploy short hedge.

Trade tips: On daily trading grounds, at spot reference: 0.6654 levels, contemplating above technical rationale it is wise to buy boundary options strikes, bid upper strikes at 0.6685 and lower strikes at 0.6635 levels.

The trading between these strikes likely to derive certain yields in this perplexed trend in the short term, more importantly, these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 0.6685 > Fwd 0.00% price > 0.6635).

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 0.6450 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 31 (which is mildly bullish ), while hourly NZD spot index was at 21 (mildly bullish ) at 08:01 GMT

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !