GBP/JPY Chartpack - Technicals & Trade Setup:FxWirePro | September 11, 2018

GBP/JPY hammers boost up consolidation phase – Trade one touch calls and long hedge ahead of BoE:

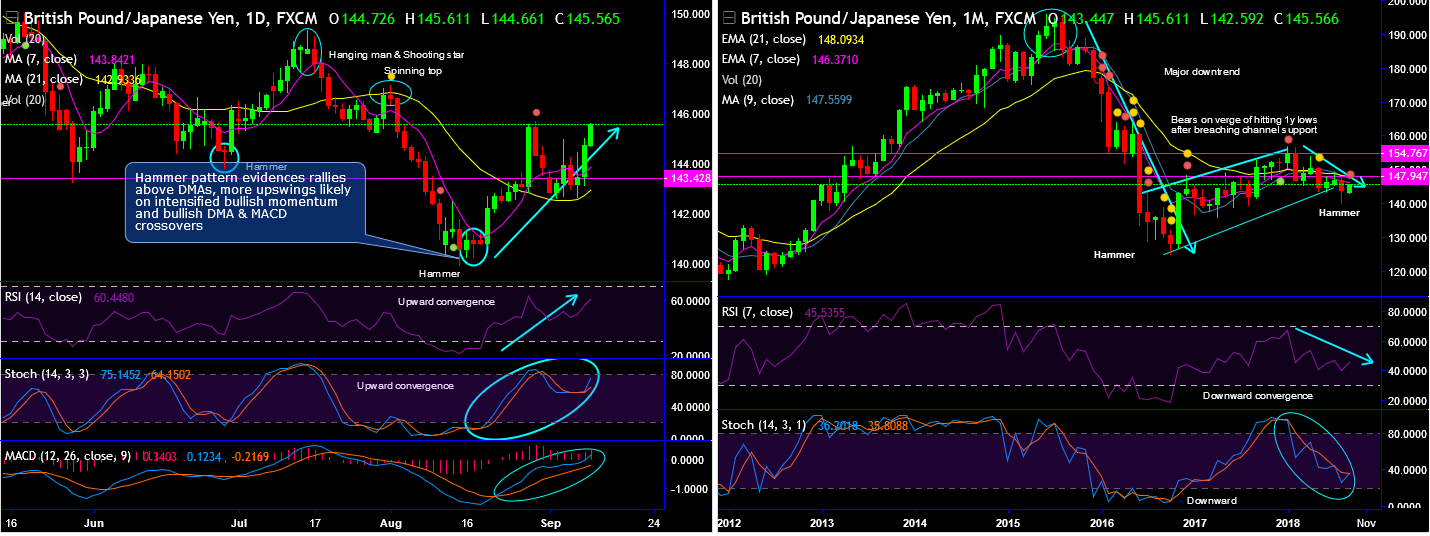

GBPJPY 0.30% chart and candlestick patterns occurred: Hammer patterns have occurred on both daily and monthly plotting at 140.827 levels and 143.828 levels respectively, one can observe the bullish sentiments thereafter.

The price rallies have gone above 7 and 21-DMAs ever since the occurrence of these bullish patterns, let’s not forget we cannot afford to isolate this signal.

The above bullish pattern is coupled with leading oscillators and bullish MACD crossover.

While on the contrary, the intermediate trend so far was spiking through rising channel (refer monhtly chart), but for now, bears have managed to breach below this channel support. In addition, shooting star candle has occurred at this juncture which is again bearish in nature and evidences considerable slumps below EMAs on this timeframe.

Consequently, both leading as well as lagging indicators have been signaling further price slumps to substantiate the above bearish patterns (refer monthly chart).

Ever since the occurrence of the breach below channel support, the price has been restrained below EMA .

Both momentum oscillators ( RSI & stochastic curves) have shown constant downward convergence on both timeframes that indicate the strength and the momentum in the bearish trend .

Trade tips:

On daily trading grounds, at spot reference: 145.525 levels, we advocate buying one touch call option using strikes at 145.689 levels. The strategy is likely to fetch leveraged yields as long as the underlying price keeps spiking on the expiration.

Alternatively, ahead of BoE MPC -0.10% meeting that is scheduled on this Thursday which is likely to be maintained status quo, one can initiate shorts in futures contracts of mid-month tenors with a view to arresting potential downside risks. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 141 (which is bullish ), while hourly JPY spot index was at -102 ( bearish ) while articulating (at 06:31 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !