EUR/GBP Chartpack - Technicals & Trade Setup : FxWirePro | April 27, 2018

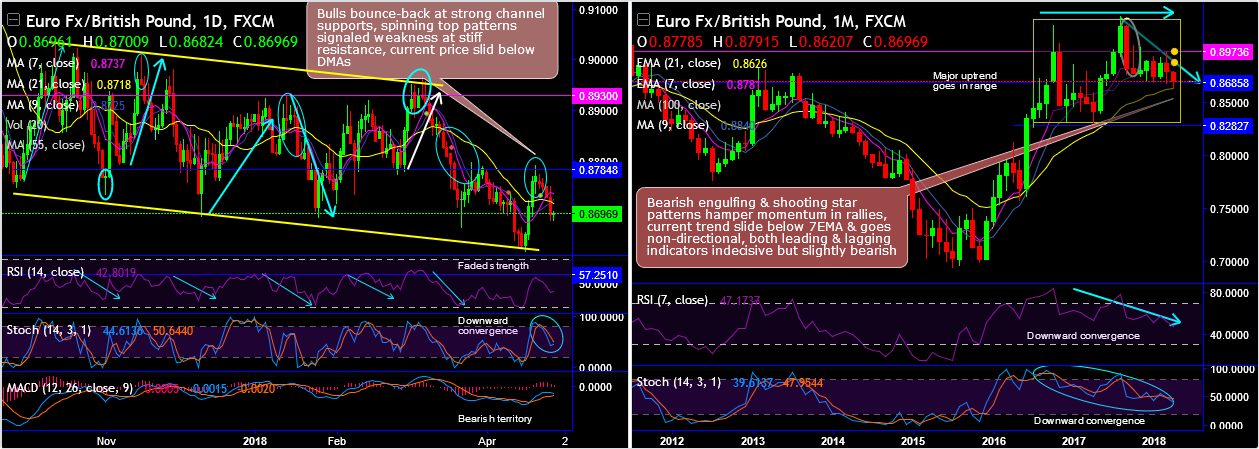

EURGBP 0.57% has been sliding through sloping channel, swings oscillating between channels.

Bulls bounce-back at strong channel supports, on the contrary, the pair forms spinning top at the stiff resistance of 0.8784 levels.

The bearish pattern signaled weakness with stiff resistance, the current price slid below DMAs.

Consequently, the bears break below strong support of 7 and 21 DMA levels after failure swings at resistance levels (refer daily chart ).

Bearish engulfing followed by shooting star patterns hamper momentum in the major uptrend, the current trend slides below 7EMA and goes non-directional, both leading indicators signal bearish momentum.

Whereas both lagging indicators on daily plotting, have been indecisive.

Both RSI and stochastic oscillators also converge downwards to the ongoing price slumps that signal intensified selling momentum.

Up until October 2016, the major trend that was bullish now goes range-bounded trend if you plot monthly chart.

On a broader perspective, we still cannot afford to disregard completely a re-test of the 2008 highs at 0.9802 before the complete transition of the Brexit process.

However, the risks of that decrease the longer we remain within this medium-term range under 0.8950-0.86 levels.

A decline through 0.86 key support would negate upside risks and suggest a move back to 0.82 and then 0.80 levels.

Trade tips:

Contemplating above shot term technical rationale, at spot reference: 0.8690 levels, you can place options trades to fetch certain yields but a limited loss structure via double-no-touch optionality in next 1-week, EURGBP 0.57% 2w DNT 0.00% with 0.8950/0.82 strikes (maintaining 50 pips as a tolerance on either side would be a wise move).

Please glance through ATM IVs nutshell, EURGBP 0.57% has been showing the least IVs among G10 FX universe (i.e. 6.43%). Thus, sell volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -122 (which is highly bearish ), hourly GBP spot index was at 56 ( bullish ) while articulating at 07:44 GMT .

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !