NZD/USD tumbles to channel support after bearish crossovers : FxWirePro | April 24, 2018

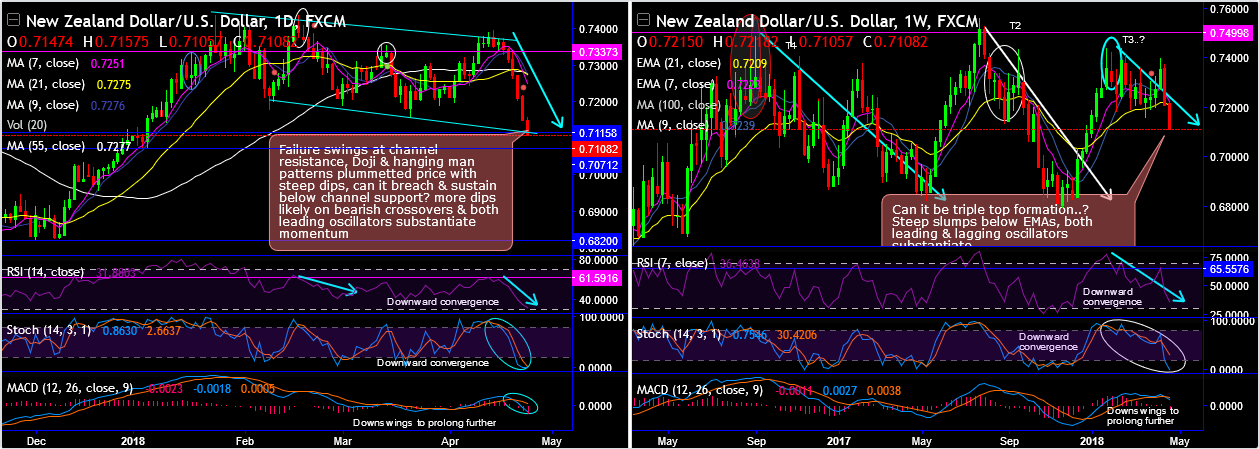

As you could refer daily plotting of NZDUSD -0.50% , the bears resume again in the minor trend especially after the failure swings at the channel resistance and tumbled towards channel supports.

The failure swings at channel resistance, the occurrence of gravestone doji and hanging man patterns have plummeted the price with steep dips, can it breach channel support? For now, more dips seem to be on cards upon bearish DMA and MACD crossovers & both leading oscillators substantiate momentum.

On weekly terms also you notice steep slumps after shooting star formation. But, can it be triple top formation is the puzzling question. As the steep slumps below EMAs are observed, while both leading and lagging oscillators also substantiate bearish interests, the triple top formation seems most likely.

Momentum study: Both leading oscillators ( RSI & stochastic curves) have been showing downward convergence along with the ongoing price dips to signal bearish momentum on daily terms, same has been the case with the momentum on weekly terms, these indicators have been in bearish favor.

Trend study: While MACD’s coupled with 7 and 21 DMAs have also shown bearish crossovers that signaled downswings to prolong further.

Next strong support levels are observed at 0.7070 marks.

In our earlier posts, we’ve advised short hedges using futures contracts of mid-month tenors with a view of arresting bearish risks, these short positions seem to have been instrumental in serving the purpose.

Overall, as the US dollar 0.11% finally came to life last week, bears are pushing NZDUSD -0.50% below its multi-month range. If it sustains the break below 0.7115 and 0.7070 levels, then a move towards 0.69 is on the cards.

On the data front, this week’s NZ 0.00% data calendar is second-tier for markets, including migration, consumer confidence, and trade balance. Next week things heat up with Q1 jobs, and the week after that it’s the RBNZ MPS.

More importantly, this week will be any surprises for the USD from US Q1 GDP and the employment cost index.

Hence, we recommend digital put options on both trading as well as hedging grounds. Use lower strikes at 0.70 levels.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -148 levels (highly bearish ), while hourly USD spot index was at shy above 152 (highly bullish ) while articulating at 07:21 GMT .

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !