Nothing changed in USD/JPY after bullish engulfing pattern : FxWirePro | April 23, 2018

USDJPY 0.23% major stiff resistance is observed at 107.856 levels.

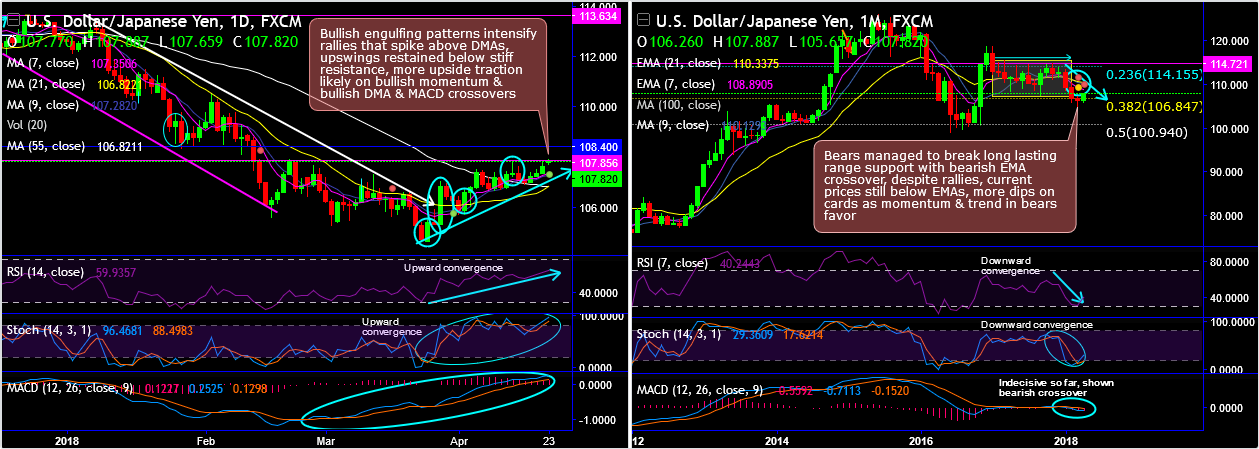

We spotted out USDJPY's bullish engulfing patterns in our recent posts, ever since then the prices have gone above 7 and 21DMAs, signaling more rallies in the days to come as it attempts to break-out stiff resistance.

Observe failure swings at the same levels, shooting star in the recent past has occurred and hampered previous bullish sentiments.

However, bulls have tested the support at 55DMAs to head towards stiff resistance zone again, we’ve seen the failure swings at this juncture twice in the recent past.

Thereby, you could observe that the momentum in the previous bullish swings is shrinking away. But if at all it manages to break-out and ensure sustenance above could drag the rallies upto next resistance at 108.400 areas.

Both RSI & stochastic curves are converging upwards on daily terms to indicate healthy buying momentum and indecisive but slightly bearish bias on monthly terms, still signaling selling pressures on this timeframe.

While the trend indicators (7&55 DMAs and MACD ) have also been showing bullish crossovers on daily terms that confirm the uptrend. Whereas the same indicators on monthly terms are indicating bearish trend remains intact.

The major trend is still stuck between 23.6% and 38.2% Fibonacci retracement levels and remains below EMAs despite this month’s rallies (refer monthly plotting), the trend on this timeframe shows failure swings exactly at 23.6% Fibonacci levels couple of times in the recent times.

Overall, we see little upside traction in the near-term and major downtrend seems to be intact.

Trading tips: Contemplating above technical rationale, we advocate buying binary call options strategy with upper strikes at 108.025, this strategy is likely to add magnifying effects to the yields as long as the underlying spot FX keeps flying above strikes on expiration. Alternatively, maintain short hedges as it is with a view to arresting downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 102 (which is bullish ), while hourly JPY spot index was at 68 ( bullish ) while articulating at 06:44 GMT

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !