Gold’s double top with bearish RSI divergence, DMA & MACD COs : FxWirePro | March 1, 2018

Gold’s double top coupled with bearish RSI divergence, bearish DMA & MACD crossovers, but consolidation phase extends rising wedge:

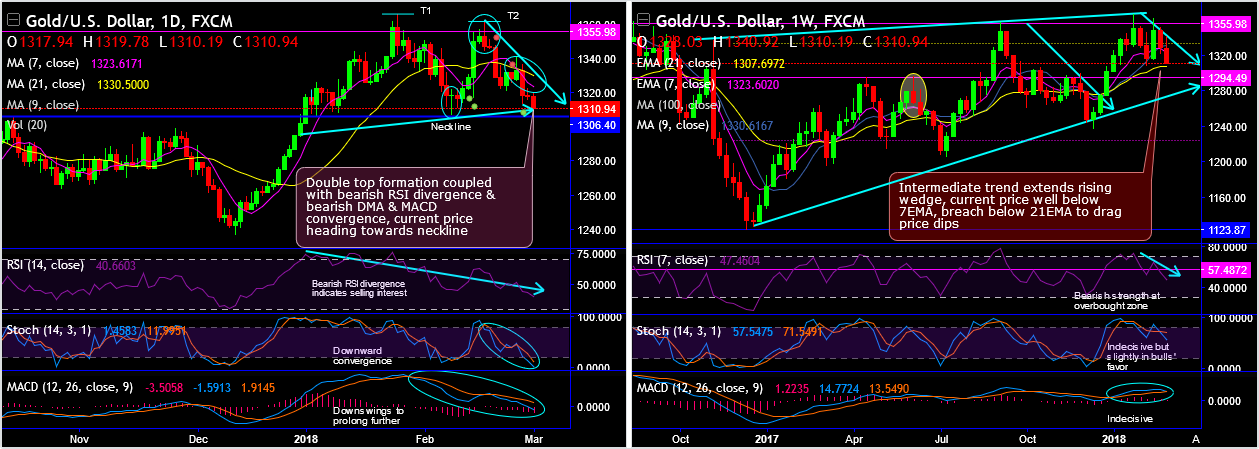

The gold -0.52% ( XAUUSD -0.55% ) bears resume exactly at rising wedge resistance but despite the bearish sentiments in the minor trend, the consolidation phase in the major uptrend on track of extending rising wedge pattern and retracing 50% Fibonacci levels.

While on daily terms, the double top formation is spotted out with top 1 at 1365.95 and top 2 at 1344.62 and neckline at 1306.40 levels. This bearish pattern is coupled with shooting star that has occurred at 1347.60, bearish RSI divergence and bearish DMA & MACD crossovers.

As a result, the bears have managed to slide the current prices below DMAs ever since the occurrence of the flurry these bearish patterns.

The minor trend sentiment has been slightly in bears’ favor.

RSI shows bearish divergence (observe price curve and RSI curve, when the price has risen from the lows of 1293.78 to the current 1310.28 levels, the leading oscillator has declined noticeably.

While stochastic curves pop up with the %D crossover even after entering into oversold territories. These indications have been extremely weaker in the minor trend.

To substantiate this bearish stance, MACD and DMAs also show bearish crossovers that signal price dips to extend further in the days to come.

Well, as with bullish swing trades, if the reward-to-risk ratio is acceptable, you could enter your trade using a sell-stop limit order.

This would result in selling underlying spot gold -0.52% once it hits your entry point.

An alternative to short selling would be to buy 1m in-the-money put option. If you choose to use options, you would use a contingent order to buy the put after the gold -0.52% price hit the entry price.

After your trade is open, you could then place a one-cancels-other order to cover both your stop loss price and your profit taking price. If one of these trades were executed, the other order would be worthless.

The strategy that focuses on taking smaller gains in short-term trends and cutting losses quicker. The gains might be smaller, but done consistently over time they can compound into excellent annual returns. Swing Trading positions are usually held a few days to a couple of weeks but can be held longer.

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !