GBP/JPY Chartpack - Technicals & Trade Setup : FxWirePro | January 15, 2018

GBP/JPY intermediate trend edges through rising wedge but hanging man nudges prices below SMAs and EMAs – Trade binary call and short hedge:

Please note that in this write-up, we emphasize more on intermediate and major trend analysis.

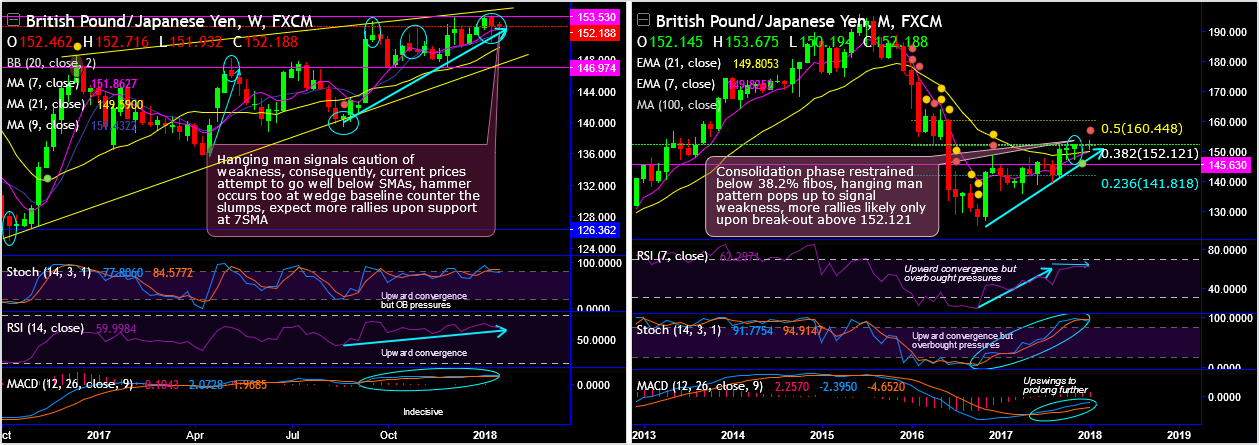

Chart and candlestick patterns occurred: the intermediate trend has been spiking through rising wedge pattern which is bullish in nature.

Hanging man has occurred last week at 152.397 levels that signals caution of weakness (refer weekly chart), consequently, the current prices attempt to go well below SMAs, hammer occurs too at wedge baseline counter the slumps, expect more rallies upon support at 7SMA.

The similar pattern ( hanging man ) has occurred even on monthly plotting at around 152.208 levels, ever since the occurrence of this bearish pattern , the consolidation phase has been edgy at the stiff resistance areas of 152.121 - 153. 600 and attempting to dip below 7EMAs.

The pair pops up hanging man at or near 38.2% Fibonacci retracement levels (at 152.121 levels) in the consolidation phase, ever since then the bulls seem to have given up their pace and showing weakness (refer monthly plotting).

The above-stated candle patterns are bearish in nature that hamper the previous bullish momentum in the consolidation phase of the major trend, if the sustenance below 38.2% level is observed then it is most likely to drag price slumps.

On a broader perspective, in this consolidation phase, any breach below EMA levels is likely to drag slumps towards 145 levels. Although we see upward convergence, the buying momentum is shrinking away on both timeframes.

The stochastic oscillator on monthly terms has entered into overbought trajectory but has been indecisive.

While RSI on the weekly chart has been slightly indecisive though converging to the price rallies to signal the strength in the buying interests. While same has been the case even on monthly terms, RSI (14) has been indecisive but trending below 63 levels that signal losing strength in the previous buying interests.

While MACD to substantiate bullish interests, signals extension of price rallies monthly terms.

Trade tips:

For an intraday speculation, we advocate buying binary call options to bet on the journey towards next stiff resistance upto 153.530 levels.

Alternatively, with a view to arresting potential downside risks, deploy shorts in futures contracts of mid-month tenors.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -38 (which is bearish ), while hourly JPY spot index was at -9 (neutral) while articulating (at 09:38 GMT ).

Submit Your Comments:

FOREX VPS FOR TRADERS

FF FOREX VPS

Windows 2012R2/2016 | Server Location Amsterdam, France, Canada | Low Latency From Brokers| Super Fast Trading Experience | All types of EA supported | 3 Days Money Back Guarantee

| Plan Name | Buy Link | CPU | RAM | Disk | BandWidth | Price (Montly) | Price (Quarterly) | Price (Semi-Annually ) | Price (Annually) | Installation | BackUp | Setup Fee |

| ECO-01 | buy now | 1 Core | 756MB | 18GB | Unmetered | $4.99/M | $4.49/M | $3.99/M | $2.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-02 | buy now | 1 Core | 1GB | 22GB | Unmetered | $5.99/M | $5.49/M | $4.99/M | $3.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-03 | buy now | 2 Core | 2GB | 30GB | Unmetered | $9.99/M | $9.49/M | $8.99/M | $7.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-04 | buy now | 2 Core | 3GB | 32GB | Unmetered | $13.99/M | $13.49/M | $12.99/M | $11.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-05 | buy now | 3 Core | 4GB | 40GB | Unmetered | $17.99/M | $17.49/M | $16.99/M | $15.99/M | MT4 Pre-Installed | Yes | Free |

| ECO-06 | buy now | 3 Core | 5GB | 45GB | Unmetered | $21.99/M | $21.49/M | $20.99/M | $19.99/M | MT4 Pre-Installed | Yes | Free |

***We accept Paypal, Perfect Money, Bitcoin !